You may be concerned about the high cost of capital gains tax upon the sale of your appreciated property.

Or perhaps you recently sold property and are looking for a way to save on taxes this year and plan for retirement. A charitable remainder unitrust might offer the solutions you need.

Benefits

Benefits

- Receive payments for life or a term of years

- Avoid capital gains when the trust sells appreciated assets used to fund the trust

- Recieve an immediate charitable income tax deduction for remainder portion of your gift to World Vision

- Accumulate undistributed earnings in the trust tax-free

- Help bring hope and healing to future generations of children

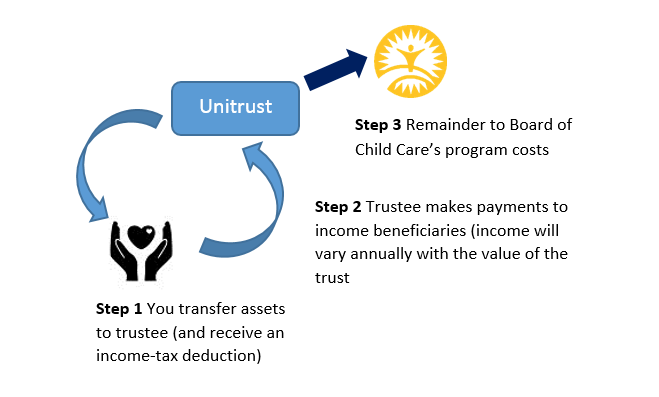

Charitable Remainder Unitrust for Income

A charitable remainder unitrust pays you income that reflects trust investments. There is the potential that your income could increase over time with growth in the trust.

How to Select the Right Unitrust Payout for You

There are several unitrust payout options to meet your needs:

- The standard unitrust pays out a percentage of the trust assets each year

- Another payout option, used commonly for real estate, permits the trust to sell the property tax free and then begin paying you income after the property has been sold

Contact Us for More Information

If you have any questions please click here to send us an email or call 1-800-CARE-734