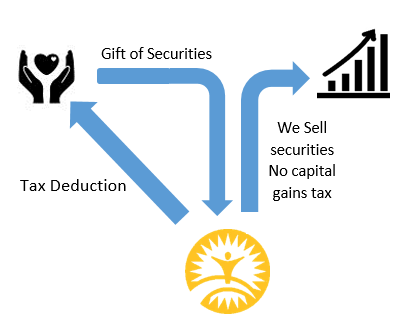

How it Works

- You transfer appreciated stocks, bonds, or mutual fund shares you have owned for more than one year to Board of Child Care.

- Board of Child Care sells the securities and uses the proceeds for our mission.

Benefits

- You receive an immediate income tax deduction for the fair market value of the securities on the date of transfer (even if you originally paid much less for them).

- You pay no capital gains tax on the transfer when the stock is sold.

- Giving appreciated stock can be more beneficial than giving cash. The “cost” of your gift is often less than the deduction you gain by making it.

Contact Us for More Information

If you have any questions please click here to send us an email or call 410-922-2100 to speak to a member of our Development team.