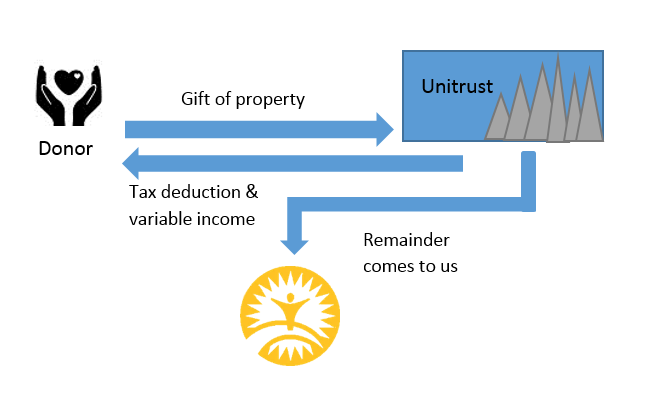

You want the flexibility to invest and manage your gift plan, and also the security of stable income.

Benefits

- Receive income for life or a term of years in return for your gift.

- Receive an immediate income tax deduction for a portion of your contribution.

- Pay no up front capital gains tax on appreciated assets you donate.

- Use the trust to meet needs that are tied to a specific time frame, such as college tuition payments.

Contact Us for More Information

If you have any questions please click here to send us an email or call 1-800-CARE-734