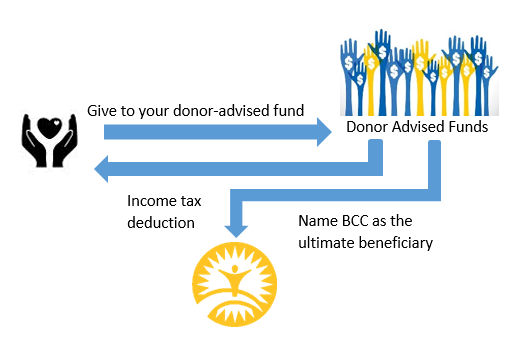

This gift plan makes sense for those strategic givers who want to contribute to our work in a way that also benefits their heirs and minimizes their tax bill.

How it Works

- Name Board of Child Care as a beneficiary of your donor-advised fund.

- Make grants from your fund to the ministries you choose, when and in the amount you want.

- The balance in your fund passes to Board of Child Care after your lifetime or when the fund closes (per your directive / the fund’s structure).

Benefits

- Involve your children and pass on a heritage of joyful stewardship.

- Maintain flexibility to change beneficiaries if your needs change during your lifetime.

Frequently Asked Questions

- How do I arrange from my donor-advised fund during my lifetime?

It is possible to make gifts from your donor-advised fund either during your lifetime or when the fund terminates. For current gifts, notify your fund administrator (using the Standard Distribution Form) that you would like to make a distribution to Board of Child Care.

- How do I arrange from my donor-advised fund when the fund terminates?

Simply contact your fund administrator and request a copy of the Change of Beneficiary Form. You can fill this in as you wish and includeBoard of Child Care for a portion or all of the remainder of your fund’s assets.

- What are the tax implications from my donor-advised fund?

Because you have already relinquished control over the donor-advised fund assets and claimed an income tax charitable deduction when you made your gift to the fund, there are no tax implications of this additional transfer from the fund to Board of Child Care.

Contact Us for More Information

If you have any questions please contact our Development team at (410) 922-2100 x5430 or email communications@boardofchildcare.org.